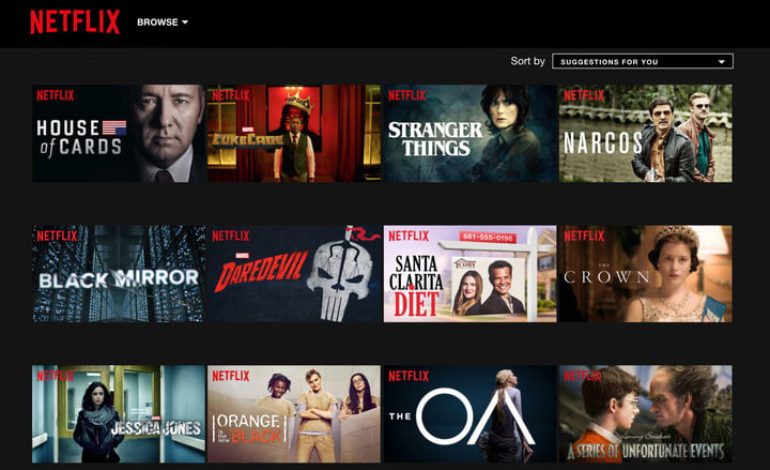

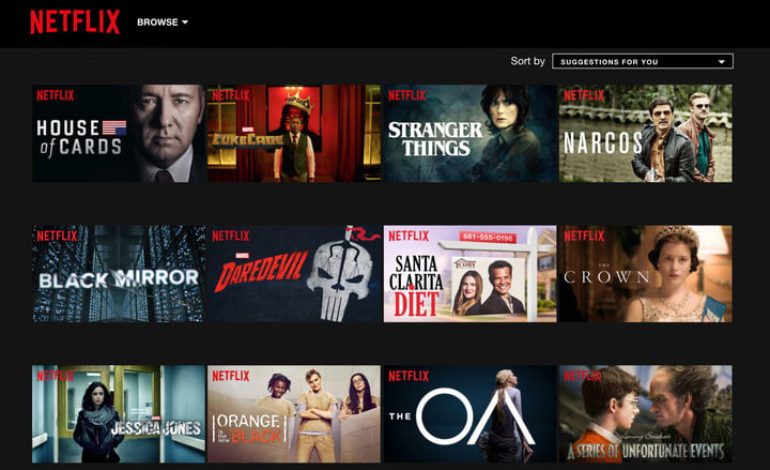

Despite its overall market share dipping consistently the past few months, Netflix’s increasing spending expenditures geared towards original content have steadily contributed to the growth of the company, which currently has about 301 original productions in the works or planned worldwide.

A severe loss in subscribers, an increased cost to debt ratio, and a further increase in similar competitors, have led the streamer to kick into gear the production of more in-house hits, leading to deals with several big names such as Beyoncé, the Obamas, and David Benioff and Dan Weiss of Game of Thrones fame. Other poached talent includes former ABC showrunners Shonda Rhimes and Kenya Barris, Gravity Falls creator Alex Hirsch, and Kenny Ortega.

“Competition is changing their business,” one partner, Michael Nathanson, mentioned during Netflix’s recent For Your Consideration event. “They’re transitioning to a more uncertain model. They have to make more original content and it has to be as good as anyone’s.”

Currently leading the SVOD (streaming-video-on-demand) market at 152 million global subscribers, many have claimed the company will never fail, while others have criticized just how long the streamer’s dominance in the market can truly last. With an increase in mounting cost, analysts have currently estimated the streaming giant has spent between $10 billion and $15 billion on content this year alone— gaining a small amount of profit in contrast to the amount of debt owed which sits at $12 billion.

Striving to compete head-to-head with Netflix’s platform, news of recent mergers and acquisitions has led other production houses such as Disney, WarnerMedia and NBCUniversal to gain an equally large amount of footing in the ongoing streaming game— with many already making moves to pull their own programming off the streamer while preparing for the launches of their own streaming services.

Disney’s decision first set the precedent, when they announced plans to stop licensing its films to the streamer ahead of the October launch of their own streaming service Disney+, which will feature titles from the Marvel, Pixar and Lucasfilm universes. Following suit, WarnerMedia and NBC Universal subsequently renegotiated syndication rights for The Office and Friends.

“That sort of shiny, new toy quality that Netflix had a couple of years ago, I’m not feeling so much in the marketplace,” commented ABC’s Entertainment president Karey Burke on the strategic moves. “People who do really care about telling stories that last for many seasons, they’re starting to turn back to cable and broadcast as really viable, if not optimal, alternatives.”

News of Netflix steadily purging its roster of original programming content also continues to taint the streaming giant’s already waning reputation. Cancellation of shows shortly after second or third seasons, many of which have gone on to become critically acclaimed, has become common place for the streamer and only adds to the air of mystery that surrounds the network’s decision making processes. Its very apparent lack of transparency in revealing viewership data further contributing to the media’s rumor mills.

Sources have claimed Netflix engages in an internal metric called “efficiency” that ultimately determines whether or not a show is truly worth renewing despite its supposed accolades and good reviews. A layman’s definition describes the term as “the ratio of the show’s cost to number of viewers.” Which according to industry sources, this is bound to play a much larger role in the streaming network’s decision to focus on obtaining new subscribers rather than keeping returning ones— those who will most likely be watching the streamer’s original content.

Despite no verifiable amount of viewership data being available, the company has somewhat begun to release select yet unverified audience numbers— usually only in tandem with publicity on popular shows such as Stranger Things. Nonetheless, international markets currently remain to be the company’s main focus and will apparently be where the majority of Netflix’s future growth will come from in the years ahead.

“The story will become whether they can sustain their U.S. subscriber level, if not try to push it up a little bit more, in the face of this rising competition,” commented Macquarie analyst Tim Nollen. While others theorize that although Netflix’s subscriber base will remain intact despite increased competition, the company will face an influx of flippant viewers who will cancel their subscriptions on and off in favor of others.